The Incubation War

- WIP

- Jun 16, 2012

- 11 min read

Updated: Dec 6, 2018

Over the past few years and all over the world, incubators and accelerator programs have been exploding. The knowledge economy world craves more startups! These initiatives, whether government-led or private, are seen in many countries as the way to create the employment they so badly need. In this month’s report, we’ll look at the various players and approaches behind this explosion, taking a particularly close look at the new breed of mobile-only players and what they mean for the industry.

Rise in mobile investment – need for feed

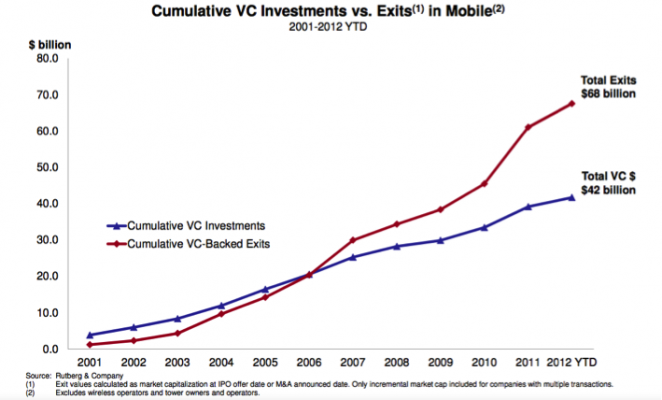

Over the past ten years, venture capital investment in mobile has grown steadily. Already in 2012, $40 billion has been invested in mobile, overtaking the amount invested in all of 2011 (see graph below). The situation is rather rosy (especially in a time of global recession), with a steady acceleration of both investment and exits. The positive outlook of the sector helps bring in further investment to mobile startups. This trend is also reinforced by the fact that recent exits have been rather early with 2-3 year old companies selling and freeing VC money faster to invest in more mobile projects.

In order to quench the thirst for new mobile startups from VCs and the matching thirst from buyers, one needs to accelerate the deal flow of mobile startups. As a consequence “incubator” type schemes aimed at supporting the creation of new mobile startups are exploding to feed the deal flow. But it’s not just a matter of number of companies entering the VC system; investors and the market want them to mature faster as the lifespan of startups and products shortens. For this reason the number of “accelerator programs” is also growing drastically.

Incubator & accelerator programs

We see different categories of players in this field with distinct practices and business models. We have classified them in the following categories:

Incubators: physical location offering, workspace and services dedicated to startups;

Accelerator programs: time-limited programs aimed at bringing startups to “the next stage”;

Vendor programs: Activities organized by a platform vendor to encourage the uptake of his platform among startups.

Sometimes these players collaborate, for example, an accelerator program is hosted by an incubator or a vendor program sponsors an accelerator program. Sometimes they overlap – for instance, some accelerator programs have their own office space. However the above provides a good base to segment the various players.

Incubators

As mentioned before, incubators are physical locations that support startups by offering them a place from which to work. Traditionally the office space offers all the basics (internet, printer, meeting room) with some of them catering for a wider need through 3rd parties (such as accountants and legal services). Increasingly a new type of incubator that we refer to as a “hub” replaces the traditional incubator model. In addition to the “basic” services, the hub provides training and regular events to help its members meet new customers, partners, collaborators or investors. This approach is also a way for the people running the incubator to derive additional revenues from venue rental and event sponsorship.

The graph above shows how different schemes cater for different levels of evolution within startups.

Increasingly incubators act like hubs, hence widening their “networking” appeal. However, this highly flexible approach means companies are encouraged to leave more quickly in their growth and settle somewhere where the team can really gel.

We have selected a number of incubators to showcase the variety in this space today. This is by no means exhaustive, though, as major cities like London see 2-3 major incubators starting every year.

Main private sponsors: Ideo, American Express, Rackspace, Vitra, Skype

This New York City-based incubator offers a large workspace for entrepreneurs, but what sets it apart is its strong education agenda. General Assembly staff scout the city for experts in varied fields (such as design SEO, development, marketing, law and fundraising) and organize practitioner-run classes for their startups but also for the community at large.

GA recently opened 2 new spaces in London and Berlin (where they have partnered with Deutsche Telekom to create an accelerator program).

Main private sponsor: Google

Google recently purchased this building in the middle of the London Tech City to host startups and entrepreneurs, but also to act as a meeting point for the entire tech community. Google however does not deal directly with startups, instead it works with a number of incubators and accelerator schemes for them to bring startups and activities on the campus. In this way Google acts merely as a building manager/office space landlord. The schemes it hosts are: Techhub, Seedcamp and Springboard. The European coordinators for startup weekend are also hosted in the same building.

Main private sponsors: Bluevia, Google, Pearson

This London incubator has been playing the role of community hub for the last 2 years in London, and recently moved to the new Google Campus (see above). Its basic offering as an incubator is centered on office space and surrounding services, but it has been extremely active at providing a central European hub for tech companies, through its numerous events, demo nights and its strong affiliation with TechCrunch Europe. In addition to London Techhub, recently opened one new building in Riga, Latvia and another in Prague.

Main private sponsors: Sprint, GM Ventures, Microsoft BizSpark, Volkswagen, SMART, DEMO, KDDI, Mitsubishi Estate Group, Turkcell Technology, Alcatel-Lucent

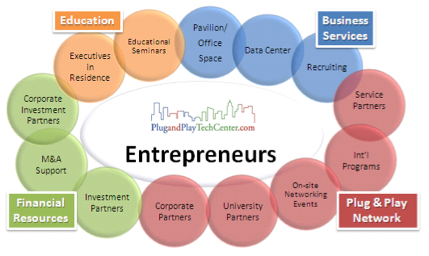

This incubator has 3 campuses in Silicon Valley (Sunnyvale, Redwood City and Palo Alto), and was launched in 2006. It has since grown to provide a wealth of services far beyond those of an incubator including web hosting, recruitment and mentorship (through their executive-in-residence program). They also have their own seed fund, an accelerator, and an international program.

Accelerator programs/Seed funds

Accelerator programs are time-defined programs following a process that accompany a startup from one phase of its development to the next. Most of these bring startups from the point where they have a founding team and a concept to raising their first angel or VC round (typically between $100k to $1M). Most of them are made of the following components:

A selection/application process aimed at discovering promising people and ideas from across a target location. For example, Seedcamp has a process to identify companies across Europe and Africa by organizing local Seedcamp weeks across Europe and bringing the winner to Seedcamp London, where the most talented teams are invited to join the program.

A 3-month to 1-year program during which the startups are hosted in an adequate working space and mentored by the accelerator’s roster of mentors and in-house entrepreneurs. Most processes emphasize lean development and frequent demos to the mentors and the rest of the group to create emulation and a “frat” feeling.

A final “demo” day at the end of the program where companies are asked to pitch to a group of VCs and angels in order to raise money for their next round of development.

The diagram above shows the positioning of accelerator program with respects to other activities in the field of start-up support activities.

As shown in the diagram, accelerator programs differentiate themselves based on the width of their offering and the accompaniment they provide to startups. In addition to the basic process (described above) that they provide, Accelerator programs also often provide additional support:

A seed fund that invests in the participating companies. The program mainly pays itself by taking an administration fee from the funds provided by VCs or angels. Participating Angels get a share in the resulting startups, typically between 3% and 10% against funds varying between $20k and $50k.

A series of free services and giveaways provided by corporate sponsors, web-hosting, free development tools, or lawyers.

Regular gatherings with the rest of the incubators’ participants and with the alumni of the program who also act as a mentoring group.

Some accelerators have their own working space but a lot of them partner with an incubator to “sub-rent” working space for the participating startups.

Similarly to incubators, accelerator programs can be found throughout the world and their numbers are always growing. However, contrary to incubators, accelerators’ success can be more easily “judged” using the amount of money raised by their startups as a metric. This is obviously not the only criteria but definitely one of interest to candidate startups.

This is probably why the Kauffman Foundation recently produced reports with rankings of the accelerator schemes in the US and in Europe. The results are here:

Top 8 European accelerators:

1. Seedcamp, pan-European

2. Startupbootcamp, Spain/Tetuan Valley

3. Startupbootcamp, Denmark

4. Springboard, UK/pan-European

5. Openfund, Greece/southeastern Europe

6. NDCR Launchpad, Ireland

7. Propeller Venture Accelerator Fund, Ireland

8. Startupbootcamp, Ireland

Top 10 US incubators:

1. TechStars, Boulder, CO

2. Y Combinator, Mountain View, CA

3. Excelerate Labs, Chicago, IL

4. LaunchBox Digital, Durham, NC

5. TechStars, Boston, MA

6. Kicklabs, San Francisco, CA

7. TechStars, Seattle, WA

8. Tech Wildcatters, Dallas, TX

9. Dreamit Ventures, Philadelphia, PA

10. The Brandery, Cincinnati, OH

Vendor Programs

Finally we have vendors’ programs, which tend to be an incubator program with a less defined and time-constrained process than the previous incubators. Their main characteristic is to be linked to a particular technology or platform vendor. As such, they primarily offer privileged routes to market thanks to the vendor running the program.

They have become a major way for companies to invest in future companies and business models in a way that their own innovation methods would not allow.

Wayra – Telefonica

Latin America, Spain, UK, Germany

Wayra was launched in 2011 in South America. The program was so successful that the concept was brought over to Europe in 2012, and launched in Telefonica’s key European strongholds. The program is a traditional accelerator, offering 6 months in a Wayra academy, seed funding of up to €50k for about 10% equity in the projects and a demo day at the end of the process. Where Wayra differentiates itself is the link with Telefonica, with information about Telefonica plans and engineers being made available to support the startups.

Microsoft Bizspark – Microsoft

Worldwide presence

The Microsoft program is highly visible within the entire incubation and acceleration space. It effectively combines different programs to touch companies throughout the entire growth process. While the program is independent, Microsoft does not hesitate to partner with many incubators and accelerators. Microsoft’s main driver is to get as many startups as possible using their Azure and .NET technologies early in the development process by giving away free tools and licenses until the business has grown to a stage where it can afford to pay for them.

Mobile only programs

In this jungle of programs, the large majority would define themselves as generic, in the sense that they invest in digital and web technologies in general. However a few mobile-specific initiatives have risen lately. There have been 2 drivers behind this new trend: on one side, the “platform war” which has led some OEMs and platform vendors to try and secure first pick on innovative applications (or at least to influence the platform they target). On the other side, the increasing realization that mobile is a lucrative startup space with promising results for a dedicated fund.

All the initiatives in this field are pretty new, but we have tried here to list some of them despite the limited amount of information available for some.

This program from AT&T is a style of incubator offering mobile startups free facilities to work from in collaboration with AT&T. The facilities, however, are not ordinary facilities, as they provide access to LTE testing equipment, devices, network API and services.

Launched May 2012

Launched in collaboration with The App Date, a series of training events specialized in mobile apps, hosted by the Hub in Madrid. This accelerator program targets specifically multi-screen apps in the education sector especially.

Launched - May 2012

The joint initiative by Microsoft, Nokia and Aalto University in Helsinki aims to foster the next generation of mobile startups. Grants are given to promising apps companies, which are then hosted within the Aalto campus where they have access to technical and design support. In addition startups can benefit from the association with Nokia and Microsoft to be showcased in their various stores.

Launched June 2012

Springboard is a London-based accelerator program created in 2009 that consists of a 3-month program attended in-house by the participating startups. Its mentors and angel investors generally have an international reputation. In Summer 2012 they launched the first European “mobile-only” accelerator with Russell Buckley (early Admob employee) as an angel.

Wavefront, a wireless commercialization center, launched in Vancouver, Canada in 2007 and expanded across Canada in 2011 as a Canadian Center of Excellence in Wireless. It is funded by federal, provincial and private funds. It hosts promising technology companies in its incubator on a revolving 6 month to 1 year basis, provides office space for startups, and organizes various education and training program to the community on a regular basis, as well as hosting a device lab. They had early partnerships with Orange, NAVTEQ and Ericsson. It has recently launched an M2M Accelerator program in conjunction with Sierra Wireless.

A mobile startup gap?

Throughout this report, we have used quite a few European names and examples, however the rise of incubator and accelerator programs is a global phenomenon. We mentioned Wayra earlier on, but iHub in Nairobi has led the path for Africa and new incubators are budding throughout Africa, with India, the Middle East and all of Asia are also following the trend. Developing countries should think “mobile first” when it comes to launching new services. While this is the case during startup weekends, this does not seem to the case within incubators (for example, Wayra projects are mainly web-centric). The under-representation of mobile services and companies among incubators can also be seen among Western programs.

The reasons behind these gaps are difficult to explain, but a few possibilities exist:

Fewer exits in the mobile sector means there are less angels and mentors available for incubator programs.

Many mobile startups manage to bootstrap based on money generated from development services, and therefore the number of companies needing an accelerator service has traditionally been more limited.

Mobile apps are seen as gimmicky and definitely not the scalable business model that VCs are after, as a consequence they are rarely selected by these programs.

Mobile should be integrated within any digital project. Mobile phones are just another screen to build for that can be considered later, once the service has proven successful on the web.

On the flip side, there are also justifications for mobile-specific programs:

Specialist investors and angels in mobile can evaluate the projects with the light of their experience.

Specialist mentors across development, design and business can bring their own experience in building across multiple platforms, and thus decrease risk and accelerate the teams’ product roadmap.

Experts in combining mobile and social to get extremely rapid uptake of services can be made available to participants rather than generic web-focused SEO experts.

In a “mobile first” world, an accelerator focused on building mobile services is more likely to succeed than one with a generic approach.

The debate still rages among the tech scene and we’ll observe the success or future of the previous programs to judge.

Recommendations

For tools & platform vendors

The number of concurrent initiatives working with mobile startups can only be a blessing! This means that it is fairly easy to find a program with which to partner and to put your product in the hands of the most promising startups. Web hosting companies have been the first to jump on this opportunity, but they’re not the only ones who can benefit. As more programs will be looking at mobile this should be a good opportunity for mobile platform or tools vendors to be the mentor advising those wanting to go mobile and seed your product with startups and developers early in the process.

For operators

The Deutsche Telekom, AT&T and Wayra initiatives are definitely ones to watch closely. It is still unclear how the early relationships with startups will impact the ability of the operators to roll-out the services they create in a mutually beneficial fashion. We also believe that offering cross-operator solutions (such as for payments or SMS) to these startup companies very early in the development process might be one of the best routes to get operator API adoption.

In general, operators would probably do well to get involved in existing accelerator programs as the costs are much lower than having their own programs and as they should be able to “touch” a much wider deal flow.

For VCs

The mobile-only accelerators are still very biased towards device manufacturers and operators, but here could be opportunities to co-invest alongside operator VC funds. Based on the results of the rare independent mobile accelerators it could be useful to see how other funds could learn from making their programs more mobile.

For developers and entrepreneurs

With the numbers of options out there, they’re in the driver’s seat. It can pay to compare the various deals proposed by various programs and look at the various program rankings. The large scope of options also means that this method is becoming a much more acceptable and tempting alternative to launching a mobile startup. This is especially true when compared with bootstrapping it yourself. It might be worthwhile doing the math and weighing the loss of a few percent in equity versus months saved in time to market.

Comentários